Kelly Criterion Sports Betting

- Kelly Criterion Sports Betting Odds

- Kelly Criterion Sports Betting Against

- Kelly Criterion In Blackjack Sports Betting And The Stock Market

- Kelly Criterion Sports Betting

- Kelly Criterion Calculator For Sports Betting

The formula was derived by J.L. Kelly, Jr in 1956. The formula has a number of applications, one of which is sports betting. Australia Sports betting has previously published a series dedicated to the Kelly Criterion, which can be followed using the links below. Introduction; Derivation; Backing and Laying Bets with Betfair. The Kelly Criterion is often a hot topic of debate amongst bettors. Pinnacle has published numerous articles on the subject, from simple explanations to complex analyses. How does a fractional approach to the Kelly Criterion work and is it the best option for serious bettors? Read on to find out. You can read more about how it works in this Kelly Criterion Wikipedia article. Usually, the bigger your edge on the odds the more you should bet but Kelly also takes into account the real chance of that bet winning and Kelly would advise a smaller bet for a 5% edge at even money (2.0) than a 5% edge at 1/3 (1.33). Because the Kelly Criterion seeks to calculate the optimum stake for any value bet so as to maximise that value as well as maximise the growth of your betting bankroll. In other words, the Kelly Criterion takes into account both the size of your advantage (I.e the value available) and the size of your bankroll, so as to minimise risk and maximise your advantage. When this solution is applied in the field of sports. The Kelly Criterion aims to increase your betting bank at the optimal – or maximum – rate possible, which is a relatively aggressive approach. Most professional bettors would not risk anywhere near 10% of their bank on a single bet, whereas the Kelly formula rarely suggests low single digits.

The following paragraphs will discuss the Kelly Criterion Sports betting strategy. It is used to create balance between reward and risk and can be applied both to investing and gambling. On that note, it is used in sports betting too. And this is what we are going to talk about in this post. This is a popular strategy that can help you minimise losses and maximise potential profits when placing your bets. It comes with a few complexities to worry about, but in general it is worth exploring. And don’t worry, we will tell you all the details you need to know about the Kelly Criterion formula like what it is and how it works.

Make sure to read the whole post to find out how you can use the strategy and when, as well as if it is a good idea to use it. Let’s get to it.

Try Kelly Criterion formula at this finest sports betting sites

| Bookie | Review | Highlights | Cash Out | Bonus | Visit |

|---|---|---|---|---|---|

| Bet365 |

| 100% Up to £100 | CLAIM BONUS | ||

| Open Account Offer. Up to £100 in Bet Credits for new customers at bet365. Min deposit £5. Bet Credits available for use upon settlement of bets to value of qualifying deposit. Min odds, bet and payment method exclusions apply. Returns exclude Bet Credits stake. Time limits and T&Cs apply. #AD | |||||

| Unibet |

| Money Back as a Bonus up to £40 if your first bet loses + £10 Casino | CLAIM BONUS | ||

| 18+ begambleaware.org. New customers only. Min deposit £10. Money back as bonus if first bet loses. Wagering requirements: sportsbook 3x at min. odds of 1.40 (2/5), casino 35x. Unless forfeited the sportsbook bonus must be wagered before using the casino bonus. Bonus expires 7 days after opt-in. No deposit required for NI customers. Call 08081699314 to claim. Full T&Cs apply. #AD | |||||

| 888sport |

| Bet £10 Get £40 | CLAIM BONUS | ||

| New Customers only, 18+. £10 min deposit. The bonus will be applied once the full deposit amount has been wagered at least once with cumulative odds of 1.5 or greater. Wagering must be cleared within 60 days. This offer may not be combined with any other offer. Deposit balance is available for withdrawal at any time. General deposit method & withdrawal restrictions apply & full T&C's apply. #AD | |||||

* T&C’s apply, 18+.

How This Strategy Applies to Sports Betting

To begin with, the Kelly Criterion sports strategy is not a strategy. It is a mathematical formula you can use to find out how much money it is best to stake on an opportunity. It helps you determine the size of the profit you can expect to generate based on your bankroll. So far, it seems like an easy and simple strategy to use. However, that is not all.

To make things work, you need to calculate the chance of a bet winning and add it to the mathematical calculations. The basic idea behind this is to make sure your overall losses are smaller and your potential overall profits are greater. To do this, you need to stake lower amounts of money when betting on outcomes that have a smaller chance of winning, and vice versa. There is no way to do that unless you calculate the expected probability of your bet winning.

Of course, whatever you do, no matter how correct your calculations are, you cannot predict an outcome with an absolute certainty.

There are quite a lot of factors that get in the way. And in general, it boils down to personal opinion because no math can tell how a game is going to play out. This is why you can never give a correct answer. And this is the reason why the Kelly gambling strategy might fail to work. We cannot teach you how to guess the outcome of a game, but we can show you how the Kelly Criterion formula works and then you can do the rest. So here it goes.

The Formula to Use

The Kelly sports betting strategy is as follows: (bp – q) / b = f

As you can see, there are a few components. We guess they do not ring a bell, so here is what each and every letter stands for:

- “F” – This symbol serves to show how much money from your bankroll you should use to make a given wager. This is also the solution to the formula.

- “B” – This is classified as the multiple of the stake you make which you can return from a given wager. Generally speaking, it is calculated by subtracting one from the odds (please note that we are talking about decimal odds!) For instance, normally, if you place a bet of £10 on odds of 3.00, you will get back £30 (£20 plus your initial stake). In this case, 3 minus 1 equals 2; hence your “b” is a multiple of 2 and the amount you win equals £20.

- “P” – This letter signifies how probable a wager is to win. It is expressed as a decimal number. For instance, if we assume that a bet has a 60% chance of winning, then it has a 0.60 probability of winning.

- “Q” – Along with a probability of a bet winning, there also is a probability of a bet losing, and it is expressed as “q” in the Kelly Criterion betting formula. Now, if there is a 60% chance of a bet winning, then there is a 40% chance of it losing. Hence, it has a 0.40 probability of losing. The fastest way to calculate “q” is to subtract “p” from 1.

Now, if we use the above examples, we can show you how the Kelly betting strategy works. We assume that our proposed wager has a 0.60 probability of winning, 0.40 probability of losing, and odds of 3.00. Then we get the following: ((2 x 0.60) – 0.40) / 2 = 0.4

As you can see, this bet has a positive expected value, something to consider when betting at any online betting website.

Expected Value

We discussed expected value in the previous sections of our guide, but just in case you are not familiar with it – this is when the possibility of a bet winning is greater than the odd’s implied probability. For instance, if there are odds of 2.00, it means that they have a 0.50 implied probability. What this means is that if you place a bet on these odds, it will have a 50% chance of winning, roughly speaking. The wager is considered to have a positive expected value if you believe it has bigger chances of winning than what the numbers express.

With that said, we want to point out that the Kelly sports strategy can be used successfully only if your bets have a positive expected value. Since people have different opinions, it should be noted that the term expected value is very subjective. Yet, you should always place wagers with a positive expected value. This means that the odds should be high.

Kelly Criterion Sports Betting Odds

Using the formula we provided above, you can avoid placing wagers with small odds. If its solution is a negative number, then the expected value of the proposed wager is not positive, therefore it is not worth making that wager.

Let us give you another example to see what we mean. Let’s assume you have odds of 3.00 just like in the previous example, but this time the bet has a 0.30 probability of winning and a 0.70 probability of losing. Here is how it looks like using the formula:

((2 x 0.30) – 0.70) / 2 = -0.05

Or let’s assume that you want to place a wager on a women’s tennis match. The sportsbook you want to bet at offers 2.60 odds on player A and 1.50 odds on player B. You think that player B has a 65% chance of winning, which means that the probability equals 0.65. You make up your mind to bet on her, and so you decide to use the Kelly Criterion formula to calculate the real chances. Here is the calculation:

((0.50 x 0.65) -0.35) / 0.50 = -0.05

The two examples express a negative value and show that it is not worth placing a bet on either opportunity because it has a negative expected value. On the surface of it, the second situation seems to offer a good chance of success, but once you do the calculations, you realise that it is not a wise idea to risk your money, as the odds are not high enough.

Pros and Cons

The formula we used above seems to be a great technique to help you avoid bad wagers and get the most of them. It does have a few good advantages to back that up. However, it also has its flaws. Here we give you the biggest pros and cons of the Kelly Criterion.

Benefits

The most obvious advantage of the Kelly Criterion betting strategy is that it helps you decide on the amount of stake to make. It takes time and practice to become adapted to using the formula and doing your calculations right, but it is relatively easy and straightforward. All you have to do is figure out which numbers you need, then you substitute the letters in the formula with them, and you do the math. The equations are not difficult either. You can use your phone’s calculator to get it right.

The second advantage is that this strategy can help you avoid placing bad bets where no positive expected value is present. It is easy to make a wrong assumption that when the probability of winning the proposed wager is higher than the probability of losing it, it safe to place a wager.

However, when using the calculation, you can see that in some cases the Kelly gambling returns a negative number, which means that the expected value is not positive. So, you cannot always tell whether a wager will be successful just by looking at the odds and probability. This is why this strategy is so popular. It gives you more clarity on the situation.

The biggest advantage of the strategy is that it enables you to apply the theoretical value of bets and manage your bankroll wisely. It helps you create a balance between protecting your bankroll and growing it, which is probably your strongest desire. The best way to maximise your profits is to bet small amounts of money when you have a low theoretical value and vice versa. This will keep you from going bust. So, explained in other words, the formula takes into account the size of your bankroll, which many other staking plans fail to do.

Downsides

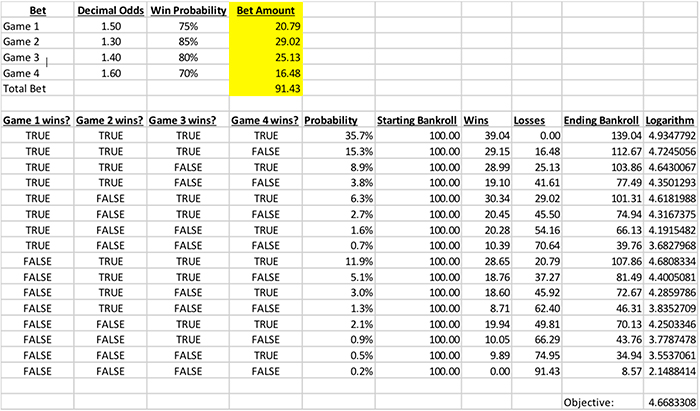

One of the disadvantages of the Kelly Criterion is that it offers an aggressive amount of money you should stake for your proposed wager. Looking at the examples we used to illustrate how the formula works, you can see that the result suggests that you stake around 5-10% of your bankroll. Using such a high amount of money on every wager bears lots of risks. The truth is that most punters bet about 2% of their bankroll, and the majority of them are not inclined to set aside more than 5% of their bankroll for a single bet.

The good news is that this issue can be easily overcome if you just reduce the amount of the stake suggested by the formula a little. For instance, you can bet half the amount. Many bettors go with the so-called fractional Kelly strategy, according to which they need to use a fraction of the stake suggested by the formula.

The biggest downside of the strategy is that it only works if you know the probabilities of the wagers. If your predictions are not correct, then the equations will not be right either. The whole concept will be worthless. It will either prevent your bankroll from growing, or it will result in a loss. The formula cannot help you find good betting opportunities.

We hope this breakdown of the Kelly Criterion sports strategy has helped you get the basic concept right and that you can use it to your advantage when placing your bets. It is important to keep in mind that the strategy does not offer magic solutions, as it can only help you determine the size of your optimal stakes. According to some, it is very beneficial; while others are convinced it is completely useless. Opinions appear to be split on this subject. We suggest you try the formula and see whether it works for you. It does not hurt to use it from time to time.

Other Types

Don’t rush into choosing your betting type, make sure you understand all of them first.

Other Betting Markets & Strategies

Proportional Staking

This involves increasing your stakes proportionately to how “wrong” you think the odds are. In a very general terms, if a horse is $7.00, when you think it should be $5.00, you might have $10 on it. But if the same horse were $12.00 then you should increase your bet size.

For many punters, this can feel counter-intuitive. Betting at bigger odds means that you don’t have to put as much down to get an attractive return, so why would you risk more? And anyway, don’t the bigger odds mean that you stand less chance of winning?

Well, in some respects, yes. But the point is that, as a punter, you have to strike when things are most in your favour. If you were offered $2.10 on a single coin toss, you might be tempted to have a bet. If you were offered $3.00, wouldn’t you bet more?

The question becomes, then: how much more?

Kelly Criterion Sports Betting Against

Minimum & Maximum Stake Limits

The issue with betting big when the odds are most in your favour means that it can only take a run of a few losing bets – which will happen no matter how much the odds are in your favour: heads sometimes comes up ten times in a row – to completely wipe out your betting bank.

To combat this, most successful punters operate some kind of system where they have a minimum and maximum stake limit – say $10 to $40 – and they select the size of bet depending on how much value they think they are getting. In these cases, the upper limit usually represents a chunk of their betting bank in the range of 2% to 5%. This means that they can endure a losing streak without having their funds wiped out. How big a percentage you are prepared to risk on your biggest bets will depend largely on your attitude to risk, but once that upper limit is set, stick to it.

Kelly Criterion Staking Strategy

One way of becoming ever more sophisticated in this bet-more-when-the-odds-are-in-your-favour approach is to adopt a strategy known as the Kelly Criterion. This was developed by a mathematician called John Kelly in the 1950s. Under analysis it has shown to be an effective way of maximising profit when operated in conjunction with a successful selection strategy.

Kelly Criterion In Blackjack Sports Betting And The Stock Market

The Kelly formula is: (BP-Q) / B

Where:

B is the odds you are getting. With decimal odds, you need to subtract 1.

P is the likelihood of the bet winning.

Q is the probability of losing, or 1 – P.

If you thought a horse should be 1.60 (which translates to 62.5% in probabilistic terms, (1/1.60)), but it was available to back at 1.70, then the sum would look like this:

((.70 x 0.625)-0.375) / .70 = 8.93%

Meaning that you should place 8.93% of your betting bank on the outcome.

However, the example above throws up a couple of immediate concerns: the size of bets that can be recommended and the need for an accurate prediction of probability.

Size of Your Bets

First, and most pressing, is that when the odds are really in your favour, the Kelly Criterion calls for you to bet significant portions of your betting bank, which is difficult to swallow for even the most aggressive punters, no matter what the mathematical proofs may tell them. To guard against the volatility that the Kelly Criterion can bring to their betting bank, most successful punters using the approach will either set a maximum upper limit for their bets, or always bet a fixed fraction of what the formula suggests.

Part of the reason for this is that the Kelly Criterion relies on a mathematically certain prediction of chance, and whilst this can be provided for a coin toss, accurately assessing the chance of a sporting outcome is usually fraught with a greater degree of uncertainty.

Accurate Prediction Models

Whether adopting a full or partial Kelly approach, or a simpler bet-more-when-the-odds-are-in-your-favour approach, the fact remains that all staking strategies are useless unless you have reliable ways of working out what odds a sporting outcome should be.

There are lots of ways to do this – with the use of ratings systems being the most popular – but this should be the challenge that punters take on before they worry about staking strategies, no matter what the internet forums might suggest.

Related Articles

Staking – Plans and Strategies

A staking plan or staking strategy is the method of defining how much of your bank you should be ...

Staking – Level Staking

Elsewhere on this site we have outlined the advantages of a staking system known as the Kelly Criterion: a method ...

Understanding Over-Round

Rivalled only perhaps by darts players, few do mental arithmetic as well as your average punter. He might have ...